1099 Market

Retirement Plans for Self-Employed People

Do you know the difference between an independent contractor versus an employee? The distinction is relatively black and white. As an Insurance agent you should know because this knowledge can add a $100 K + on your account.

Say What?.. Yes, 40% of business owners prefer to hire an independent contractor or outsource their contract instead of handle employees, in large part to save on labor costs. Furthermore, there is no need to pay benefits, and companies can also save on taxes because it’s not necessary to pay the employer portion of Social Security and Medicare or state unemployment taxes. For independent contractors this mean that at the end of the year they receive a 1099 form . A contractor is responsible to pay for his or her tax, social security and must definitely prepare his (her) retirement, but it not always be the case.

Say What?.. Yes, 40% of business owners prefer to hire an independent contractor or outsource their contract instead of handle employees, in large part to save on labor costs. Furthermore, there is no need to pay benefits, and companies can also save on taxes because it’s not necessary to pay the employer portion of Social Security and Medicare or state unemployment taxes. For independent contractors this mean that at the end of the year they receive a 1099 form . A contractor is responsible to pay for his or her tax, social security and must definitely prepare his (her) retirement, but it not always be the case.

Statistics shows that

- 45% of self-employed workers aged between 35 and 55 have no private pension

- 30% of self-employed workers aged over 55 have no private pension

Northwestern Mutual's 2018 Planning & Progress Study, which surveyed 2,003 adults, found that 21 percent of Americans have nothing saved at all for their golden years, and a third of Americans have less than $5,000. To put that into perspective, it means that 31 percent of U.S. adults could last only a few months on their savings if they had to retire tomorrow.

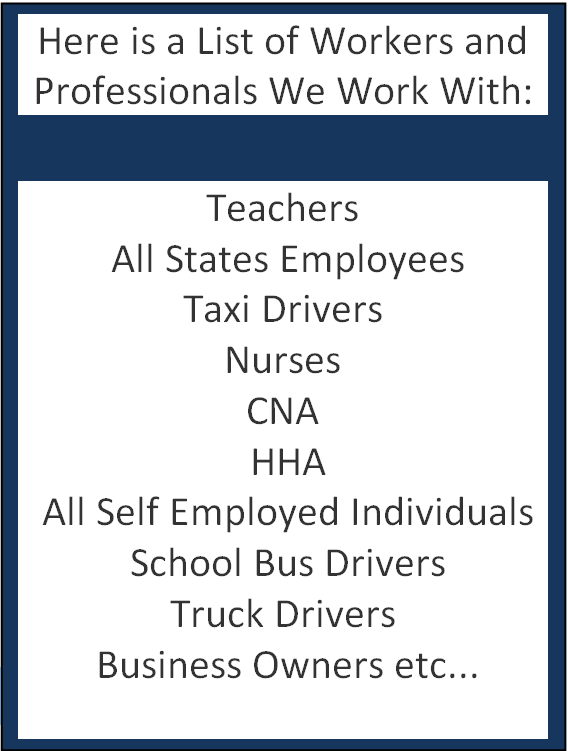

This is when you become more relevant as an agent ,you will be tasked to help in setting up personal retirement accounts for persons, regardless of their background or status.

The market is huge and filled with opportunity.

@2018 VL Insurance. All rights reserved.