Training Videos

- Get licensed to sell annuities

- Learn annuity basics

- Learn how to fact find

- Improve your ability to problem solve

- Build relationships and service your customers

Fact finding Tips for Selling Annuities

The fact finding process of selling annuities is one of the toughest parts for new agents to learn. It’s important to understand your client’s objectives and you can’t do that unless you’re a seasoned listener.

Here are some tips during your fact finding process:

- Always set expectations on the first appointment

- Never discuss performance in the first appointment

- Ask questions and listen

- Listen again, and keep listening

- Use a structured fact finder to take notes

- Never leave your first appointment without setting your second appointment

Annuities 101

Here are some critical facts you should know about annuities to help you better educate your clients.

Facts about fixed annuities every consumer should know.

- Safe alternatives without market risk compared to mutual funds, stocks, etc.

- Tax deferred growth and/or distribution of retirement savings (not a stock market investment, security or an indexed mutual fund).

- Purchasing “Options” protect funds from loss in market is how customers have downside protection with upside potential. More about this below.

- Minimum interest guarantees and multiple crediting methods for growth.

- Annual ratchet & reset for steady, safe, growth (upside potential with downside protection).

- No loss of initial or future contributions, and bonus options.

- Lifetime income complies with required minimum distribution (RMD) guidelines.

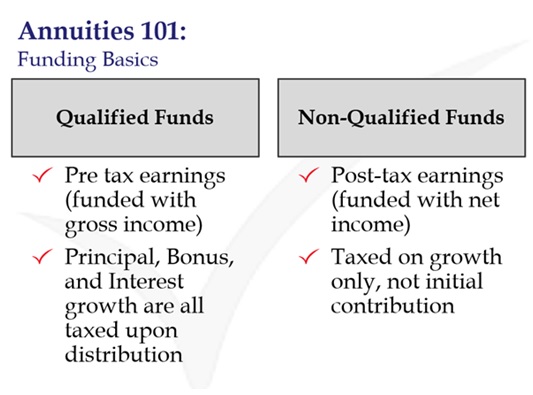

Difference Between Qualified funds vs. Non-Qualified funds

@2018 VL Insurance. All rights reserved.